| Date | Event |

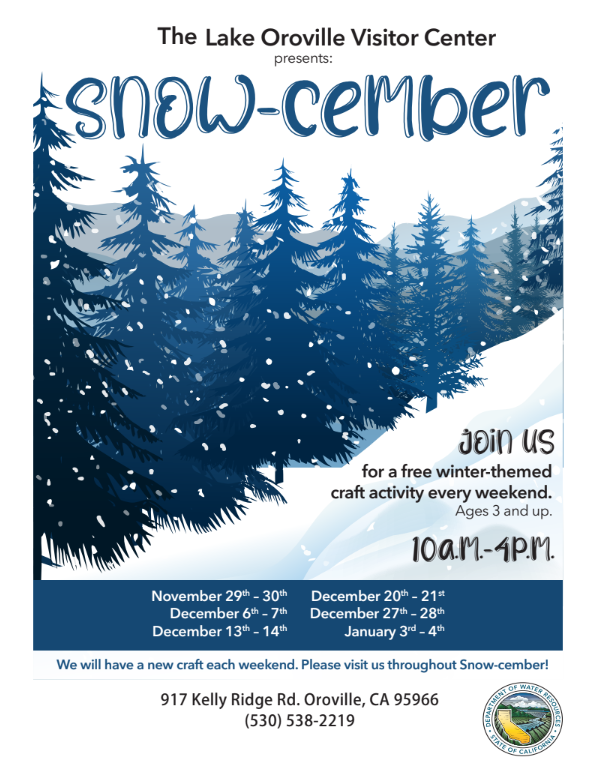

| 1/3/2026 -1/4/2026 |  more info... |

| 1/8/2026 | This 4-weeks series is designed to teach you how to utilize your financial statements to better manage and understand your business operations, cash flow, and profitability. Focus includes: interpreting and understanding your financial statements (Profit & Loss, Balance Sheet) hands-on exercise and case study; identifying cash flow cycle and how it impacts your business; learning how to calculate and use financial ratios to troubleshoot fiscal dangers, and analyzing trends to improve business performance; using financial tools to make good business decisions for effective spending and break-even analysis; knowing how to think critically when looking at pricing and costs; and developing forecasts and budgetary tools and techniques to improve profit. You can access free individual one-on-one business consulting simultaneously, or after the series. more info... |

| 1/15/2026 | This 4-weeks series is designed to teach you how to utilize your financial statements to better manage and understand your business operations, cash flow, and profitability. Focus includes: interpreting and understanding your financial statements (Profit & Loss, Balance Sheet) hands-on exercise and case study; identifying cash flow cycle and how it impacts your business; learning how to calculate and use financial ratios to troubleshoot fiscal dangers, and analyzing trends to improve business performance; using financial tools to make good business decisions for effective spending and break-even analysis; knowing how to think critically when looking at pricing and costs; and developing forecasts and budgetary tools and techniques to improve profit. You can access free individual one-on-one business consulting simultaneously, or after the series. more info... |

| 1/22/2026 | This 4-weeks series is designed to teach you how to utilize your financial statements to better manage and understand your business operations, cash flow, and profitability. Focus includes: interpreting and understanding your financial statements (Profit & Loss, Balance Sheet) hands-on exercise and case study; identifying cash flow cycle and how it impacts your business; learning how to calculate and use financial ratios to troubleshoot fiscal dangers, and analyzing trends to improve business performance; using financial tools to make good business decisions for effective spending and break-even analysis; knowing how to think critically when looking at pricing and costs; and developing forecasts and budgetary tools and techniques to improve profit. You can access free individual one-on-one business consulting simultaneously, or after the series. more info... |

| 1/29/2026 | For the first time in history, the U.S. workforce consists of five generations working side by side. Each generation brings unique experiences, values, and communication styles that shape how they interact with others in the workplace. Generational Diversity is designed to equip leaders with the knowledge and skills necessary to understand, collaborate, and lead across generational lines, ensuring a harmonious, high-performing team. Learning Objectives:

Why This Matters for Your Organization:

Ready to transform your team by embracing generational diversity? Register now and empower your organization to thrive in today’s multi-generational workforce! Trainer Bio: Dr. Joc Clark has 25+ years of experience in leadership and organizational change. He specializes in strengths-based leadership and coaching, using experiential methods to foster collaboration and transformation. Joc holds a PhD in Leadership & Change Management and an MEd in Organizational Development. ETP members contact: etp@butte.edu more info... |

| 1/29/2026 | This 4-weeks series is designed to teach you how to utilize your financial statements to better manage and understand your business operations, cash flow, and profitability. Focus includes: interpreting and understanding your financial statements (Profit & Loss, Balance Sheet) hands-on exercise and case study; identifying cash flow cycle and how it impacts your business; learning how to calculate and use financial ratios to troubleshoot fiscal dangers, and analyzing trends to improve business performance; using financial tools to make good business decisions for effective spending and break-even analysis; knowing how to think critically when looking at pricing and costs; and developing forecasts and budgetary tools and techniques to improve profit. You can access free individual one-on-one business consulting simultaneously, or after the series. more info... |

Events available for Registration... |

Events in the month of January 2026 | |||||||||||||||||||||||||||||||||||||||||||||||||